how much is inheritance tax in wv

As of 2022 here are the ranges for each of the six states that collect inheritance tax. Inheritance tax rates range from 0 up to 18 of the value of the inheritance.

A Guide To West Virginia Inheritance Laws

West Virginia collects neither an estate tax nor an inheritance tax.

. Inheritance tax rates vary widely. No estate tax or inheritance tax. One option is convincing your relative to give you a portion of your inheritance money every year as a gift.

The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the. No estate tax or inheritance tax. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to.

There is no inheritance tax in West Virginia. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. As of 2021 only estates worth more than 117 million are taxed and only on the amount that exceeds that number.

Avoiding Inheritance Tax. Inheritence Estate Tax. 65 on taxable income of 60001.

Inheritance tax rates depend on the beneficiarys relation to. Everyone is pleased to learn that West Virginia has adopted the Federal guidelines with regard to inheritance and estate tax. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million.

The Economic Growth and Tax Relief Reconciliation Act of 2001 has also eliminated the estate tax in West Virginia. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. West Virginia collects neither an estate tax nor an inheritance tax.

Surviving spouses are always exempt. Besides getting married or convincing your family members to move there are other steps you can take if youre trying to figure out how to avoid an inheritance tax. Inheritance taxes differ from estate taxes as inheritance taxes apply to the beneficiary.

Technically it can happen in two cases. How estate taxes work. If the gross estate does not exceed the.

If the estate is appraised for up to 1 million more than that threshold the estate tax can be in excess of 345000. How Much Is the Inheritance Tax. West Virginia collects neither an estate tax nor an inheritance tax.

However there are certain cases when West Virginia residents may find themselves responsible for federal taxation that can reach as much as 40 of the inherited estate. Washington has the highest estate tax at 20 applied to the portion of an estates value greater than 11193000. 2193 million Washington DC District of Columbia.

States may also have their own estate tax. An estate tax return is only required if the gross estatethe combined gross assets and prior taxable giftsexceeds 117 million in 2021 or 1206 million in 2022. No need to go through a bank for the money.

Like most states there is no West Virginia inheritance tax. However state residents must remember to take into account the federal. The top estate tax rate is 16 percent exemption threshold.

No need to go through a loan approval process. An inheritance tax requires beneficiaries to pay taxes on assets and properties inherited from a deceased person. 56 million West Virginia.

No estate tax or inheritance tax. 77 Fairfax Street Room 102. If you are a sibling or childs spouse you dont pay taxes on inheritance under 25000.

Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. In 2022 anyone can give another person up. State inheritance tax rates range from 1 up to 16.

That means if you inherit property either real property personal property or intangible property like financial accounts or cash you will not have to pay an inheritance tax in WV West Virginia inheritance tax. Paying for the fees associated with the West Virginia probate process. Estate tax applies at the federal level but very few people actually have to pay it.

6 on taxable income between 40001 and 60000. As previously mentioned the amount you owe depends on your relationship to the deceased. Other inheritances may be taxed if they are required to be included with the heir or beneficiaries taxable income.

45 on taxable income between 25001 and 40000. A few states have disclosed exemption limits for 2022. In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million.

If you are a spouse child parent stepchild or grandchild youll pay no inheritance tax as the entire amount is exempt. However state residents must remember to take into account the federal estate tax if their estate or the estate they are. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

Most estate taxes are levied at the federal levelbut many estates arent subject to them. The advantages of an inheritance cash advance in West Virginia include. Berkeley Springs WV 25411.

An immediate influx of cash. There is no federal inheritance tax but there is a federal estate tax. The focus of estate taxes is on the value of a dead persons assets and whether it exceeds the estate tax threshold.

The estate tax exemption for New York increases to 611 million while that for Washington state remains unchanged at nearly 220 million. In Washington State there is no inheritance tax. The top estate tax rate is 20 percent exemption threshold.

13 rows West Virginia Inheritance and Gift Tax. Anyone else pays inheritance tax of 0 16 but in.

West Virginia Estate Tax Everything You Need To Know Smartasset

A Guide To West Virginia Inheritance Laws

West Virginia Income Tax Calculator Smartasset

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

West Virginia Estate Tax Everything You Need To Know Smartasset

A Guide To West Virginia Inheritance Laws

How To File For Divorce In West Virginia 2022 Guide Edivorce

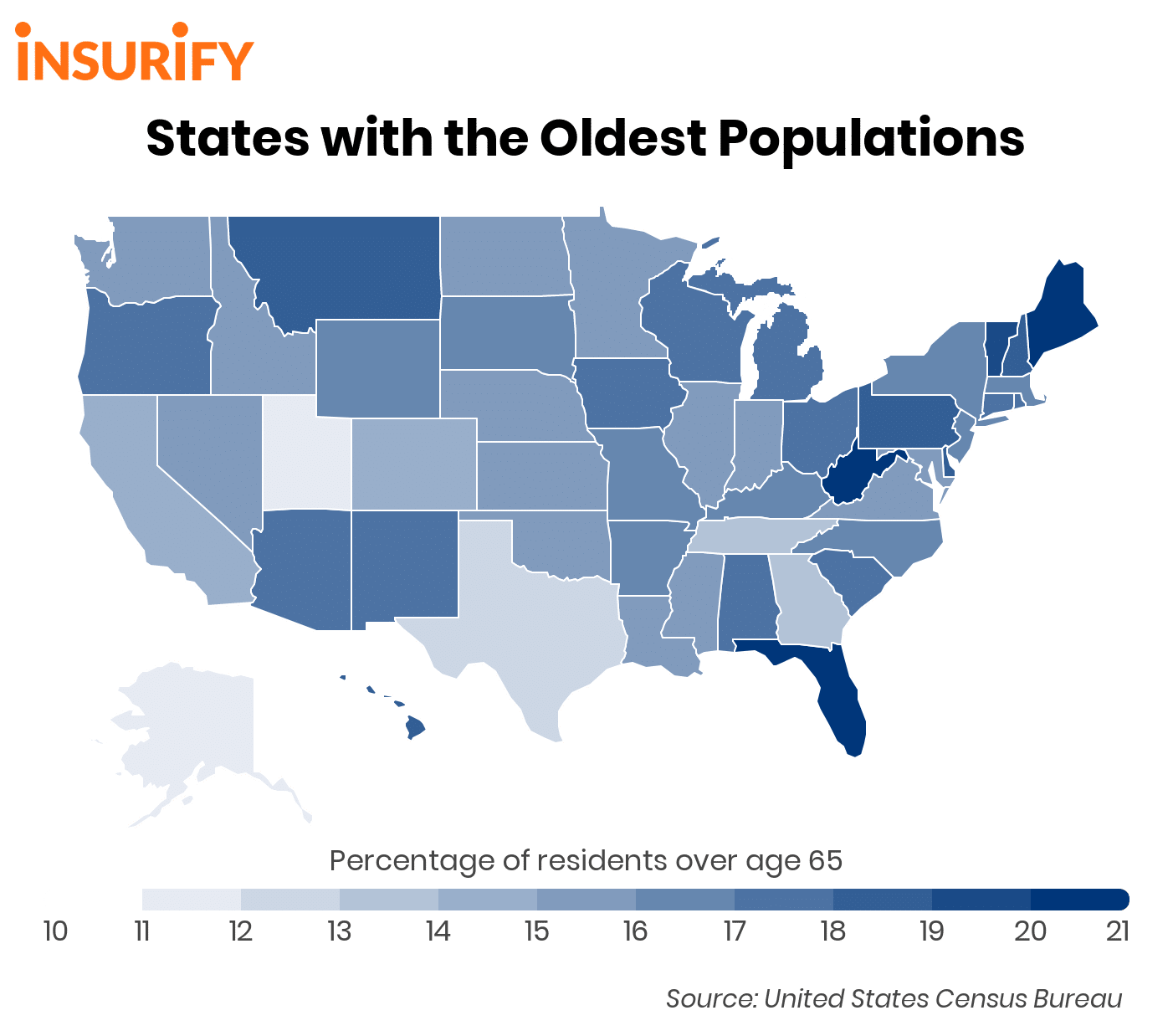

West Virginia Has Third Oldest Population In The United States Wboy Com

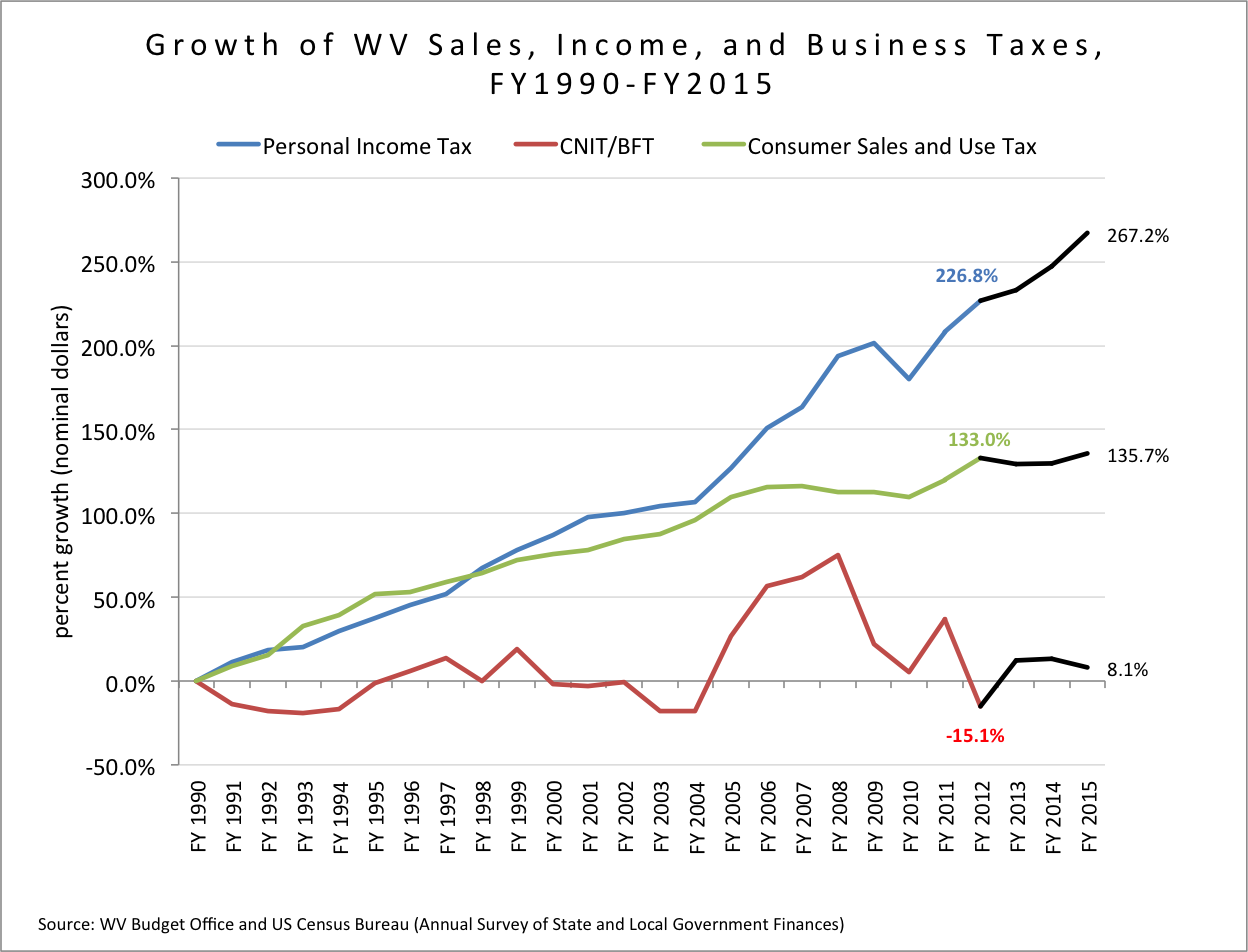

Historical West Virginia Budget And Finance Information Ballotpedia

Wv Budget Gap A Revenue Problem Part 2 West Virginia Center On Budget Policy

Historical West Virginia Tax Policy Information Ballotpedia

Session Is Over Here S What Passed What Didn T News Register Herald Com

West Virginia Income Tax Calculator Smartasset

/usa--west-virginia--charleston--kanawha-river-and-skyline--dusk-CA22372-5a5353d29802070037bb6e5a.jpg)

Dying With No Last Will And Testament In West Virginia

West Virginia Estate Tax Everything You Need To Know Smartasset

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc